We are coming out of a decade where interest rates were very low, as low as 2.5% per year. Rates are now up over 7.0%. This makes it hard for buyers getting new loans to qualify. When they do qualify, they qualify for lower loan amounts. This in turn lowers sale prices.

It appears that the higher rates are going to be the “new normal”.

In response to this situation some buyers are taking over sellers’ loans to take advantage of the seller’s low interest rate. Buyers can apply for formal assumption. Or buyers can pay the seller a down payment and informally assume or “wrap around” the seller’s existing 2.5% loan without notifying the seller’s lender. This is referred to as a “confidential closing”.

In a wrap-around transaction the buyer will give the seller a deed of trust mortgage and pay the seller each month. The seller will continue to make payments to the seller’s lender. The best way to deliver the payments to the lender is for the buyer to pay a collection agent, which will then pay the seller’s lender in the seller’s name. In most cases the seller and buyer do not notify the seller’s lender that there has been a sale.

Read more about the wrap-around deed of trust as a seller financing tool.

Seller-financing offers another advantage to buyers because it avoids the hassle of having buyers get a new loan. Qualifying for financing is tricky. Mortgage closing costs can really add up. There are only two parties to a seller-financed deal, buyer and seller, instead of the usual three parties. The lender is not there to rain on the parade. In romance two is company and three is a crowd. With buyer and seller and no new lender, the same is true in real estate transactions.

In a wrap-around transaction, at a much lower interest rate, the seller can get a higher sale price, while the buyer will get lower monthly payments.

The seller must decide how much the buyer is to pay as a down payment. The seller might require the buyer to pay the seller all of the seller’s equity in the property.

The seller must get to know the buyer and look into the buyer’s credit worthiness and reliability. There is some risk here because a buyer who fails to pay or pays late could negatively impact the seller’s credit rating. If the buyer fails to pay, the seller might have to make the monthly payments himself or foreclose on the wrap-around deed of trust.

If a buyer does not have a significant down payment or high credit worthiness, the deal might be structured as a lease with an option to purchase in a certain number of years.

Read more about lease-option transactions at this link.

Regarding credit score, I find there are frequently buyers who have bad credit or a recent bankruptcy, but who on the other hand have large amounts of cash to make a big down payment..

“Creative financing” is usually synonymous with “seller financing”, although “creative financing” is a broader term that can include formal assumption, informal assumption, wrap-around, or lease option.

Seller financing has been around for a very long time. Read about the recent history of creative financing or seller financing here.

Are you a seller having trouble selling your property for the price it would have commanded two years ago before rates went up? A big part of the problem is that buyers in general are having a hard time getting financing or qualifying for loans that are large enough. This is reducing the number of potential buyers willing to pay the seller’s asking price.

Maybe the property needs work and does not appraise for enough. Some buyers are “handy”, meaning they can accept the property as-is and do needed repairs. They might then qualify the property for refinance in a reasonable time.

Why not eliminate the new loan obstacle? Why not sell utilizing a lease-option or a wrap-around deed of trust or an assumption – with or without lender approval? Why make the buyer go get a new loan? Let the buyer use he seller’s existing loan.

Before 1986 almost all residential bank loans could be assumed or “wrapped around” or “taken subject to”. Before 1986 many states, including Washington and California, regarded due on sale clauses as “impediments to sale” or “restraints on alienation” and therefore void, at least as to residential properties. Read the case of Lipps v. First American Serv. Corp. for a good discussion of restraints on alienation.

Then in 1986 Congress passed the Garn St. Germain Act. The due-on-sale clause in paragraph 17 or 18 of your deed of trust became enforceable under federal law.

The customary due-on-sale language is as follows:

“Transfer of the Property or a Beneficial Interest in Borrower. As used in this Section 18, “Interest in the Property” means any legal or beneficial interest in the Property, including, but not limited to, those beneficial interests transferred in a bond for deed, contract for deed, installment sales contract or escrow agreement, the intent of which is the transfer of title by Borrower at a future date to a purchaser.

“If all or any part of the Property or any Interest in the Property is sold or transferred (or if Borrower is not a natural person and a beneficial interest in Borrower is sold or transferred) without Lender’s prior written consent, Lender may require immediate payment in full of all sums secured by this Security Instrument. However, this option shall not be exercised by Lender if such exercise is prohibited by Applicable Law.

“If Lender exercises this option, Lender shall give Borrower notice of acceleration. The notice shall provide a period of not less than 30 days from the date the notice is given in accordance with Section 15 within which Borrower must pay all sums secured by this Security Instrument. If Borrower fails to pay these sums prior to the expiration of this period, Lender may invoke any remedies permitted by this Security Instrument without further notice or demand on Borrower.

Many or most attorneys and real estate brokers are afraid to “go around” a due-on-sale clause. Most attorneys and brokers tell buyers they have to get new financing so the seller can pay off his or her loan. However, seller financing can work, although it has to be done carefully and with full disclosure to all parties. It helps if your broker is also an attorney.

Even if a lender calls in a loan based on the due-on-sale clause, the law spells out that the lender should allow the buyer to assume the loan if the buyer qualifies by customary credit standards. The rate on the assumed loan would be one that is below market but higher than the lower, current rate.

In the exercise of its option under a due-on-sale clause, a lender is encouraged to permit an assumption of a real property loan at the existing contract rate or at a rate which is at or below the average between the contract and market rates, and nothing in this section shall be interpreted to prohibit any such assumption. …

For any contract to which subsection (b) does not apply pursuant to this subsection, a lender may require any successor or transferee of the borrower to meet customary credit standards applied to loans secured by similar property, and the lender may declare the loan due and payable pursuant to the terms of the contract upon transfer to any successor or transferee of the borrower who fails to meet such customary credit standards.

The Code of Federal Regulations provides that if the buyer qualifies by customary credit standards and if the lender and buyer come to agreement on the new interest rate, the seller will be released from all liability on the loan:

Upon such agreement and resultant waiver, a lender shall release the existing borrower from all obligations under the loan instruments, and the lender is deemed to have made a new loan to the existing borrower’s successor in interest.

The 2008 recession reduced property values and repressed the real estate market. Many sellers gave up attempts to sell their properties and let them go into foreclosure. Short sales became common. A solution would have been for Congress to have suspended or relaxed the enforceability of due-on-sale clauses. Seventy percent of mortgages are owned by Fannie and Freddie, and they could suspend enforcement of Paragraph 18 of the standard deed of trust with the stroke of a pen. I wrote to President Obama about this. I also wrote to the president of Fannie, the president of Freddie, the secretary of the treasury, and the head of the FED. So far only Ben Bernanke responded. He like the idea but said it was outside his jurisdiction.

Many real estate brokers and attorneys are intimidated by the due-on-sale clause. They presume that the only option the buyer has is to obtain a new loan. Brokers usually work only with buyers who are pre-qualified.

However, bear in mind that the due-on-sale clause only gives the lender the right to call in the loan. The loan is not automatically due.

Further, I have been closing wrap-around transactions for many years. I have talked with many real estate attorneys and lenders about their policy on due-on-sale clauses. Not once, in all my conversations with other attorneys, brokers, and lenders has any lender ever called a loan due under a due-on-sale clause. The only exception is where there is another basis for default, for example, failure to pay payments.

Generally, mortgages get combined into large bundles and collateralized. They are converted into a stock issue. Investors buy shares in it the stock issue. Generally, lenders have no interest in calling in due-on-sale loans as long as payments are being made.

In a seller-financed deal that is set up properly the buyer will monthly payments to a collection service. The collection service pays the lender in the seller’s name and keeps a record of everything, the running balance, any late payment penalties, and the payoff amount. The collection service might hold an executed full reconveyance.

If you are a frustrated buyer, especially one having trouble getting financing, tell your broker to look for a seller who will carry the balance. You are more likely to find a willing seller if you work through a broker. When your broker finds a willing seller, tell your agent to call me. I will help him “land the airplane”. I would be glad to serve as your buyer broker.

You might find a seller on your own, and if you do, contact me and I will write up the deal and get it through escrow.

Bear in mind that VA and FHA loans are assumable, provided that the buyer proves credit worthiness by customary credit standards, which may be less strict than standards for new loans. A possible reason for the reduced strictness is that the seller is not released from liability, which means the lender will have two parties “by the hind leg” and liable to pay the mortgage.

If you are a broker working on a deal, don’t be shy about calling. The phone number is 425-774-6611 ext 1. If I am not available ask for attorney Matthew Parker whose phone number is 425-774-6611 ext 2.

I generally handle the escrow as well as advise and represent the buyer or seller. I am available to put on seller-financing seminars at real estate offices.

I give brokers, buyers, and sellers by telephone, giving a free initial consultation. I want to know if I can help people before I ask them to sign a contract and pay a retainer. I generally charge $3,000 for handling the escrow. In addition, I generally charge $300 per hour to set up the transaction. A typical legal fee is $3,000 to $4,000.

Creative financing, seller-financing, wrap-around mortgages, lease-option deals work for residential property, second homes, rental houses, commercial property, apartment buildings, and building lots.

When a buyer and a seller find each other and want to buy and sell using creative financing, buyer or seller or broker should bring in a real estate lawyer to write up the deal and see that it gets closed properly and safely and to make sure that everyone gets full disclosure. These creative financing deals are complicated and it takes technical expertise to write them up. I have lost count of how many of these wrap-around deals I have written or reviewed or escrowed.

The selling broker and buyer broker normally write up deals for no extra charge. Brokers are authorized to write purchase agreement if standard forms will cover all the issues. Broker errors and omissions insurance will not cover brokers if they go past standard, lawyer approved forms. But with seller-financing, there are no standard forms. Each deal is different. A lot of issues have to be addressed. Brokers have earned their commission when they bring buyer and seller to the point where they have reached a basic oral agreement. It is not the Broker’s duty to write up a complex deal. I advise brokers to write up the deal as best he can on standard forms and include language such as this:

At this stage this is a non-binding, good faith letter of intent, which shall become binding when it is reviewed and rewritten by a real estate attorney and signed by buyer and seller.

I then take over. It is my job to add the technical details, identify and address all issues, and get the deed, note, deed of trust, lease-option agreement, collection account agreement, and other documents drafted and escrow the transaction.

The buyer or seller can hire me and pay me a fee to draft creative financing documents. They can select me as the escrow agent. Or I can work as co-listing or co-selling broker. I can do that because I am also a licensed real estate broker. This may not necessarily cost the broker anything. The seller might agree to raise the commission enough to cover my fee. Under that arrangement I might take all or part of my fee at closing.

Whether I work as listing or selling broker or as listing co-broker or selling co-broker, I am representing my client both as attorney and real estate broker. The party which hires me is getting the services pf a real estate co-broker and a real estate lawyer.

When there is another attorney involved, I work with that attorney to find a workable strategy and explain to him or her why I believe a creative financing transaction would be reasonable and safe. I urge the party I am not representing to get legal counsel.

I am only licensed to practice in Washington. If your property is in another state, and if you still want to hire me, you would also need to hire co-counsel in your state who will “sponsor” me.

Disclosure: In all cases I make it clear that I am not making a guarantee that the lender will not call the loan due, although, again, I know of no instance where a lender has called a loan due based solely on the due-on-sale clause. In all cases I insist that the buyer agree that if the loan is called due that the buyer will refinance or sell the property and hold the seller harmless. Many or most buyers are investors, and generally they have the financial ability to refinance or sell the property if a lender might call the loan due.

I make sure that the buyer and seller sign a statement reassuring the title company that title insurance does not include coverage against the possibility that the lender might call the loan due based on the due-on-sale clause.

Read what attorney William Bronchick has to say about beating the the due-on-sale clause.

Read about Dodd-Frank restrictions as they might apply to seller financing.

Click here to sign up for my email list.

James Robert Deal, Broker and Attorney

Broker with eXp Realty

WSBA # 8103, DOL # 29770

425-774-6611

James@JamesDeal.com ![]()

Co-Broker

As both a real estate attorney and a real estate broker, I co-broker with other brokers, helping them to take more listings and service them better. This provides better service for sellers.

Call A Real Estate Attorney BEFORE You Buy or Sell

Call a real estate attorney BEFORE you buy or sell property. Call Attorney James Robert Deal at 425-774-6611. In many cases I offer a flat fee, payable at closing out of escrow.

How Much Is Your House Worth?

What is your Washington home worth? Click here to find out.

JRDeal-NewZ-12-13-17 CDC Manipulated Results Anthrax Vaccine Sickens Soldiers

JRDeal NewZ JAMES ROBERT DEAL Political Activist - Real Estate Attorney - Real Estate Broker 425-774-6611 December 3, 2017 Read Online at:...

Puget Sound Market Prices Up

Home prices in Seattle have doubled over the past five years.

Questions To Ask Before You Buy A Home

Questions to ask before you buy a home.

Prince Did Not Have A Will – Do You?

Prince died without a will. Do not make the same mistake.

The Foreclosure Train Rolls On

Private corporations such as Loan Star and Caliber bought thousands of mortgages. The government pays them to modify mortgages, but they are quick to foreclose. They invest in high value instead of low value homes. They should be required to serve the interest of the local neighborhood as are banks. They should be regulated as banks.

Buy This Book – Chain of Title

Chain of Title How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud Purchase hardcover — $27.95 Available: April 2016...

You Need A Lawyer When Doing A Modification

You should be represented by an attorney when you are modifying your mortgage. Servicers break the rules.

Mortgage Modification Successes

Most of our clients are people who tried to modify their loans on their own and failed. Mortgage modifications are tricky. There are procedures...

Banks Losing Right to Require Arbitration

CFPB may allow consumers to sue banks and file class action cases. Banks will not be able to hide behind mandatory arbitration.

Bothell Real Estate Attorney

I am a real estate attorney serving Bothell, Washington. Contact me at 425-771-1110 or 888-999-2022.

Real Estate Attorney And Real Estate Broker

James Robert Deal is both a real estate agent and a real estate attorney practicing in Lynnwood Washington. If He is your broker, he does not charge extra for legal work related to your transaction.

Author

What To Serve A Goddess When She Comes For Dinner Welcome To My Book I highly recommend it. I had a lot of fun writing it. My book has 464 page...

Buyers With a Good Down Payment But Poor Credit

If you are a would-be buyer who has a good down payment and good income but poor credit, I am willing to help you buy property on a lease-option or contract basis. James Robert Deal, attorney and broker. 425-771-1110

Seeking Lease Option and Contract Sellers

Seeking Lease-Option and Seller Contract Sellers Open Phone Line to Brokers, Buyers, Sellers 425-774-6611 - 888-999-2022 I am working with...

Let Freedom Ring – Song

Let Freedom Ring – a song by vaccine rights attorney Allan Phillips.

Underwater Properties – Short Sales – Modification

James Robert Deal, real estate attorney and real estate agent, handles mortgage modifications and short sales.

Condo Dues – Short Sale Then Bankruptcy

Deal with unpaid condo dues by short selling the condo and going through Chapter 7 bankruptcy.

Open Telephone Line

James Robert Deal, Attorney and Broker, in Lynnwood Washington

Blacks Against Mandatory Vaccination

African-American community rages against manditory vaccination in California and the Tuskegee-like crimes of mandatory vaccines that destroy black...

$5,000 Principal Reduction

Republicans want to put an end to HAMP and Making Home Affordable.

Services We Offer

We have an open telephone line to brokers, buyers, sellers, and clients in general who may need help with buying or selling real estate or who may...

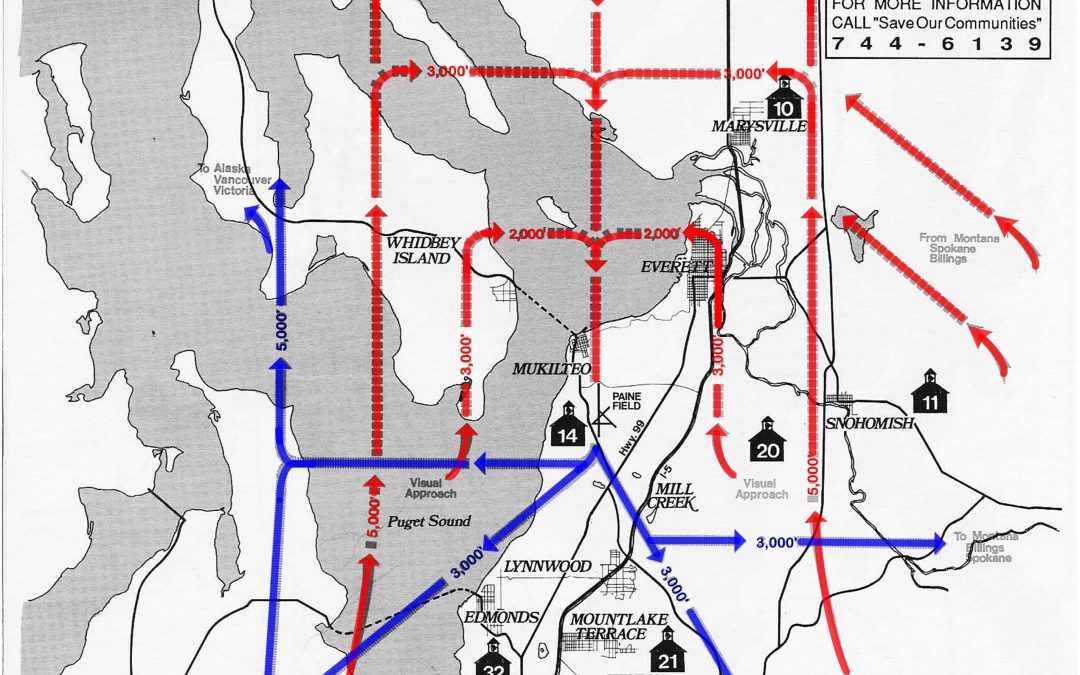

Door-To-Door Transit

Door-To-Door Transit: The Only Solution To Our Traffic Nightmare by James Robert Deal, Attorney Traffic is bad and getting worse, and there is no...

Seller Financing History

AN ABBREVIATED HISTORY OF CREATIVE FINANCING AND SELLER FINANCING. The first form of financing was seller financing.

I Help Brokers Do Seller Financed Deals

Attorney James Robert Deal helps brokers structure seller financed real estate transactions.

Lease-Option Deals Open Doors

LEASE-OPTION AND LEASE PURCHASE DEALS A lease-option or lease-purchase deal is a form of seller financing. With the lease-option deal, title stays...

Helping Sellers With Seller Financing

Attorney James Robert Deal helps sellers who are sell using seller financing, including assumptions, wrap-arounds, real estate contracts, or lease option.

Servicers Make More Money By Modifying Than By Foreclosing

Thanks to Martin Andleman and Mandleman Matters Why Does Ocwen Want to Modify Loans? Answer: Because they profit by doing so. In case you...

Zombie Foreclosures

CFPB: Zombie foreclosures hurt borrowers The Consumer Financial Protection Bureau is keeping an eye on “zombie” foreclosures, which it worries cause...

New Federal Rules on Foreclosure

New Federal Rules on Foreclosure —By Erika Eichelberger - Thanks to Mother Jones On Thursday, the Consumer Financial Protection Bureau, the federal...

Washington MERS Suits Fail

Judges Dismiss MERS Suits By Evan Nemeroff Two borrower-initiated lawsuits alleging that the Mortgage Electronic Registration Systems role in the...

Eminent Domain – Tool For Principal Reduction

There are homes by the thousand in which the home mortgage is in default and in many cases the homes are abandoned. These are homes where the...

Chapter 13 Plan Duration

No Minimum Time Length For The Ninth Circuit by Bankruptcy Law Network (BLN) Written by Michael G. Doan Thanks...

Modification on Rental

It is harder to get a mortgage modification on a rental property than it is on an owner occupied property. The rules are not as clear. You need a...

Making Home Affordable Continues

HAMP continues aiding borrowers Three firms still fall short in meeting servicing goals. Thanks to Housing Wire. Kerri Ann Panchuk December 9, 2013...

Rental Property Modification

This is a rental property modification. Ocwen was the servicer, and the investor was Washington Mutual and now Chase. The owner quit paying for 20...

$157,105 Wells Fargo Principal Reduction

JS is a hard working taxi driver. He came to us after a financial hardship, including a divorce. Ocwen is his servicer, however, the important fact...

Wells Fargo – 3 Year Modification

It is a long story, which I will tell later. For now I will just share the link with you and tell you that this modification took three years to...

Preferences

What is a Bankruptcy Preference? by KENT ANDERSON on AUGUST 16, 2010 A bankruptcy preference is a transfer made shortly before the case is filed...

Principal Reduction Modification

We just negotiated this excellent modification with Bank of America. The interest rate was reduced to 2.0%. The principal balance was reduced by...

Condemn Underwater Mortgages – Martin Andelman

Carpe Domum! The Little City that Could: Richmond, California THANKS TO MARTIN ANDELMAN Come with me to the City of Richmond in Northern...

How Long Before I Can File BK Again?

How Long Before I Can File Bankruptcy Again? There is no limit on the number of bankruptcy cases that one may file, nor on the time which must pass...

Deceptive Practices in Foreclosures

Deceptive Practices in Foreclosures Thanks to the New York Times September 13, 2013 In early 2012 when five big banks settled with state and...

Low Modification Approval Rate

This post comes from Martin Andelman. The low approval rate on modifications Martin discusses is the main reason why you should hire an attorney to...

Bankruptcy Timing

Bankruptcy Timeline Posted on August 21, 2013 by Jonathan Mitchell Thanks to Attorney Jonathan T. Mitchell. Caution: This timeline does not include...

Renters’ Rights in Foreclosure`

Renters in Foreclosure: What Are Their Rights? Federal law gives important rights to tenants whose landlords have lost their properties through...

Eminent Domain To Modify Loans

A City Invokes Seizure Laws to Save Homes Peter DaSilva for The New York Times Thanks to New York Times. Robert and Patricia Castillo paid $420,000...

Fannie and Freddie Loosen Modification Guidelines

FHFA expands suite of loan mod tools By Kerri Ann Panchuk • March 27, 2013 • 9:00am Servicers dealing with loans guaranteed or owned by Fannie...