Dodd-Frank Seller Financing

How Dodd Frank Affects Buyers & Sellers

The Offices Of James Robert Deal, WA Attorney & Real Estate Broker, Can Assist Buyers and Sellers In Navigating Dodd Frank Seller Financing Regulations

DODD FRANK AND SELLER FINANCING

JAMES ROBERT DEAL, J.D.

425-774-6611 x 1

MATTHEW PARKER

425-774-6611 x 2

The law office of James Robert Deal does escrow closings and escrow setup for wrap-around, due-on-sale, seller-financed, creative financing transactions.

Our office also does escrow setup and escrow closings for commercial real estate transactions.

In some cases our office can do escrow setup in all 50 states.

Our office closes for-sale-by-owner transactions in Washington.

If you sell your property on seller financing, you may be required to comply with Dodd Frank restrictions on seller financing.

The issue centers around whether a licensed loan officer working for a licensed loan company must be consulted.

Most transactions are exempt, and that means that there is no need to consult with a loan officer. If the transaction is not exempt, that means that the seller is acting as an unlicensed loan officer.

These restrictions apply if the deal is a recorded, seller-financed, wrap-around deal. Some experts say that a lease option is not a sale, perhaps because it is not recorded, and that Dodd Frank does not apply. Some loan officers say it does, maybe so they can charge a fee to approve the financing.

Dodd Frank can limit the right of buyers and sellers to do seller-financing. However, many transactions are exempt from these limitations.

To be exempt means that the parties will not have to hire a loan officer and qualify the buyer as if the buyer were obtaining a bank loan.

If a transaction is not exempt, the parties should hire a loan officer and qualify the buyer as if the buyer were obtaining a bank loan.

If the lender is a third party making a loan to a buyer who does seller financing with a seller, the transaction is exempt from Dodd Frank, and there is apparently no requirement that the seller to hire a loan officer to bless the transaction.

Even if the transaction is exempt, there are limits. Let’s start with the one-property exemption.

One Property Exclusion: Only sellers who are individuals, trusts, or estates can take advantage of the one property exclusion. Corporations, LLC’s, and partnerships must use the three-property exclusion. Most seller-financed transactions fall into this exemption. If a seller sells a home that the seller has lived in to a buyer who will live in the home, the seller can sell one such home and not be required to qualify through a mortgage broker. The transaction is said to be exempt. However, the interest rate for the first five years must be fixed. Thereafter, the rate and payment may increase. The law probably allows a five year balloon payment cash out, although the law does not state this explicitly. I presume that a five-year balloon would be allowed under the one-property exclusion because the three-property exclusion prohibits a five year cash out and requires a full 30-year amortization, while the one-property exclusion says noting one way or the other. It is clear that the rate can go up after five years to a level which will give the buyer incentive to refinance. After five years, rate increases of 2.0% per year, based on a margin plus a recognized index, up to 6.0% over the life of the loan are allowed.

Three Property Exclusion: Sellers who are individuals, trusts, estates, corporations, LLCs, and partnerships must luse the three-property exclusion. If a seller sells a home, not necessarily one the seller lived in, and the seller sells no more than three properties per year, the transaction is exempt. No loan officer need be consulted. The interest rate for the first five years again must be fixed. Thereafter the rate and payment again may increase. No negative amortization loans are allowed. It is clear under the three-property rule that for the transaction to be exempt, the seller must give the buyer a 30-year mortgage. The rate must be fixed for the first five years. The rate can go up after five years to a level which would compel the buyer to refinance. After five years, rate increases of up to 2.0% per year, based on a margin plus a recognized index, up to 6.0% over the life of the loan are allowed.

Dodd-Frank only applies to residential properties. This includes one-to-four unit housing, raw land, and vacant lots sold for residential purposes.

If a seller sells to a buyer who is going to do a fix and flip as a contractor and not live in the property, the transaction is exempt.

If the terms of the seller-financed transaction are negotiated by an attorney who is not earning a mortgage fee, the transaction is exempt. No loan officer need be consulted.

If a seller sells to a buyer who is not going live in the property, Dodd Frank does not apply. This means the parties will not have to hire a loan officer and that the seller can require full payoff in fewer than five years and that the interest rate may be variable from the start. It means that the buyer need not consult with a mortgage broker and qualify financially.

If the interest rate is above the usury limit of 12.0% in Washington, the transaction is not exempt from Dodd Frank.

Negative amortization loans are not exempt.

Dodd Frank treats the seller who is not an individual but is a builder differently and presumably such transactions are not exempt. Presumably, that means that buyers must qualify through a loan officer.

The best advice to give to those sellers who are not exempt is for them to spend $400 and pay a loan officer to qualify buyers by customary credit standards.

The Department of Financial Institutions is not going to track down common violators of these rules. The impact of the rules is that when the seller files foreclosure against the buyer who is not paying, the buyer is going to have a counterclaim and a defense. A fee of $400 is a small amount to pay to circumvent this thicket of regulations.

Quoting from the Barnes-Walker firm:

What happens if there is a violation of the Dodd-Frank Act and other related laws? The penalties are very harsh if there is a violation of the various federal requirements, including the Dodd-Frank Act, the SAFE Act, RESPA, and the Truth In Lending Act, in that there could be a private right to sue for violations and to be reimbursed attorneys’ fees and costs, penalties of up to $4,000.00 to $5,000.00 per day at a minimum, $25,000.00 for reckless violations, and $1,000,000.00 per day for knowing violations. There could also be actions against the violator such as rescission or reformation of contract, refund of borrower costs, return of interest paid, return of real property, restitution, disgorgement or compensation for unjust enrichment, private damages, other monetary relief, and other relief currently undefined.

You have to be very careful in that the Act targets not just owner/lenders and seller-financers, but it is also a danger to real estate agents who arrange for credit and set up a loan, particularly if the agents receive compensation. In such cases, these agents might also be considered loan originators and have to be licensed under the new laws. This risk changes Realtors’® normal and historic business model, as they often help borrowers locate and find different forms of financing for properties. Providing clients with uncompensated general information about mortgages or lists of reputable lenders, though, does not appear to bring a real estate agent or broker under the definition of a loan originator. However, if an agent’s or broker’s efforts exceed these acts, there could be some liability.

Compare the SAFE Act, a Washington’s law that elaborates on Dodd Frank. Read the Washington DFI explanation here.

And you should also read this article pertaining to Washington law entitled Residential Seller Financing under the Consumer Loan Act.

Read the following items for more information. You will see there is quite a bit of divergent opinion as to how it applies to seller financing.

Read the Dodd Frank rules on seller financing:

http://www.consumerfinance.gov/eregulations/1026-36/2013-30108_20140118

Read the Washington regulations regarding the Washington SAFE act and seller financing:

http://www.dfi.wa.gov/documents/seller-financing/residential-seller-financing.pdf

http://www.realtor.org/topics/seller-financing/the-safe-act

http://frascona.com/dodd-frank-consumer-financial-protection-owner-financing/

http://www.ksefocus.com/billdatabase/clientfiles/172/4/1720.pdf

http://www.legalwiz.com/owner-financing-dodd-frank-safe-act/

http://files.consumerfinance.gov/f/201301_cfpb_final-rule_ability-to-repay-interpretations.pdf

https://scholarship.richmond.edu/cgi/viewcontent.cgi?article=1037&context=law-faculty-publications

https://www.washingtonattorneybroker.com/dodd-frank-and-seller-financing-2/

This article is my best attempt at interpreting this thicket of unclearly written regulations. Do not rely on my interpretation without consulting with me, some other attorney, or a licensed loan office.

Click here to sign up for my email list.

James Robert Deal, Broker and Attorney

Broker with Agency One Realty LLC

WSBA # 8103, DOL # 39666

425-774-6611, 888-999-2022

James at James Deal dot com

James Robert Deal, Attorney & Broker

Co-Broker

As both a real estate attorney and a real estate broker, I co-broker with other brokers, helping them to take more listings and service them better. This provides better service for sellers.

Call A Real Estate Attorney BEFORE You Buy or Sell

Call a real estate attorney BEFORE you buy or sell property. Call Attorney James Robert Deal at 425-774-6611. In many cases I offer a flat fee, payable at closing out of escrow.

How Much Is Your House Worth?

What is your Washington home worth? Click here to find out.

JRDeal-NewZ-12-13-17 CDC Manipulated Results Anthrax Vaccine Sickens Soldiers

JRDeal NewZ JAMES ROBERT DEAL Political Activist - Real Estate Attorney - Real Estate Broker 425-774-6611 December 3, 2017 Read Online at:...

Puget Sound Market Prices Up

Home prices in Seattle have doubled over the past five years.

Questions To Ask Before You Buy A Home

Questions to ask before you buy a home.

Prince Did Not Have A Will – Do You?

Prince died without a will. Do not make the same mistake.

The Foreclosure Train Rolls On

Private corporations such as Loan Star and Caliber bought thousands of mortgages. The government pays them to modify mortgages, but they are quick to foreclose. They invest in high value instead of low value homes. They should be required to serve the interest of the local neighborhood as are banks. They should be regulated as banks.

Buy This Book – Chain of Title

Chain of Title How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud Purchase hardcover — $27.95 Available: April 2016...

You Need A Lawyer When Doing A Modification

You should be represented by an attorney when you are modifying your mortgage. Servicers break the rules.

Mortgage Modification Successes

Most of our clients are people who tried to modify their loans on their own and failed. Mortgage modifications are tricky. There are procedures...

Banks Losing Right to Require Arbitration

CFPB may allow consumers to sue banks and file class action cases. Banks will not be able to hide behind mandatory arbitration.

Bothell Real Estate Attorney

I am a real estate attorney serving Bothell, Washington. Contact me at 425-771-1110 or 888-999-2022.

Real Estate Attorney And Real Estate Broker

James Robert Deal is both a real estate agent and a real estate attorney practicing in Lynnwood Washington. If He is your broker, he does not charge extra for legal work related to your transaction.

Author

What To Serve A Goddess When She Comes For Dinner Welcome To My Book I highly recommend it. I had a lot of fun writing it. My book has 464 page...

Buyers With a Good Down Payment But Poor Credit

If you are a would-be buyer who has a good down payment and good income but poor credit, I am willing to help you buy property on a lease-option or contract basis. James Robert Deal, attorney and broker. 425-771-1110

Seeking Lease Option and Contract Sellers

Seeking Lease-Option and Seller Contract Sellers Open Phone Line to Brokers, Buyers, Sellers 425-774-6611 - 888-999-2022 I am working with...

Let Freedom Ring – Song

Let Freedom Ring – a song by vaccine rights attorney Allan Phillips.

Underwater Properties – Short Sales – Modification

James Robert Deal, real estate attorney and real estate agent, handles mortgage modifications and short sales.

Condo Dues – Short Sale Then Bankruptcy

Deal with unpaid condo dues by short selling the condo and going through Chapter 7 bankruptcy.

Open Telephone Line

James Robert Deal, Attorney and Broker, in Lynnwood Washington

Blacks Against Mandatory Vaccination

African-American community rages against manditory vaccination in California and the Tuskegee-like crimes of mandatory vaccines that destroy black...

$5,000 Principal Reduction

Republicans want to put an end to HAMP and Making Home Affordable.

Services We Offer

We have an open telephone line to brokers, buyers, sellers, and clients in general who may need help with buying or selling real estate or who may...

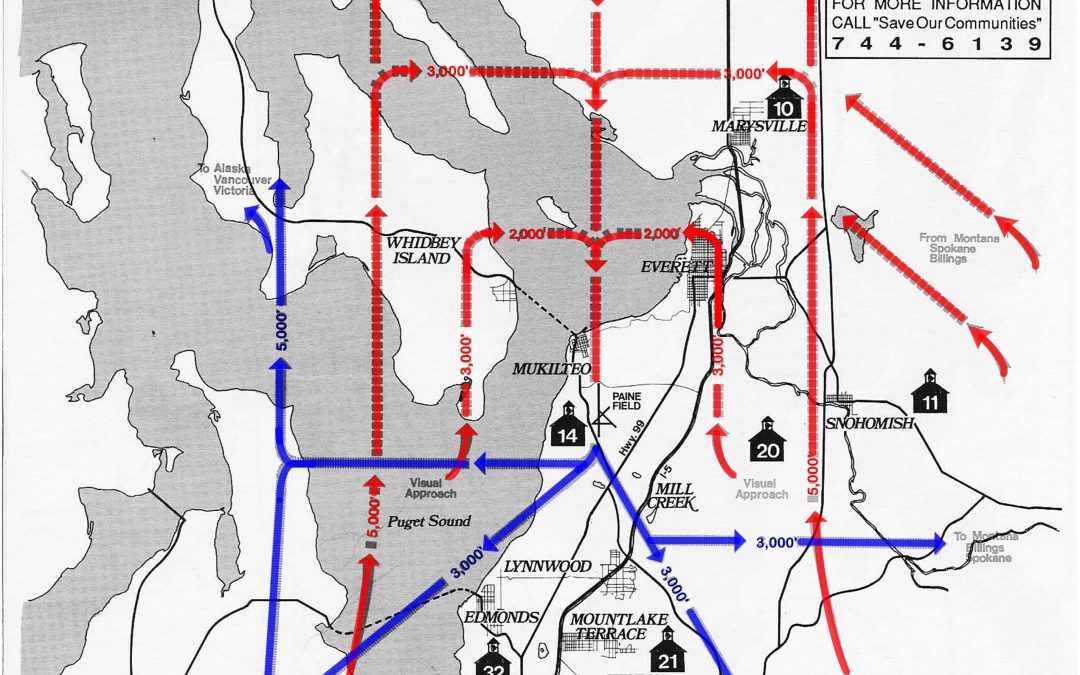

Door-To-Door Transit

Door-To-Door Transit: The Only Solution To Our Traffic Nightmare by James Robert Deal, Attorney Traffic is bad and getting worse, and there is no...

Seller Financing History

AN ABBREVIATED HISTORY OF CREATIVE FINANCING AND SELLER FINANCING. The first form of financing was seller financing.

I Help Brokers Do Seller Financed Deals

Attorney James Robert Deal helps brokers structure seller financed real estate transactions.

Lease-Option Deals Open Doors

LEASE-OPTION AND LEASE PURCHASE DEALS A lease-option or lease-purchase deal is a form of seller financing. With the lease-option deal, title stays...

Helping Sellers With Seller Financing

Attorney James Robert Deal helps sellers who are sell using seller financing, including assumptions, wrap-arounds, real estate contracts, or lease option.

Servicers Make More Money By Modifying Than By Foreclosing

Thanks to Martin Andleman and Mandleman Matters Why Does Ocwen Want to Modify Loans? Answer: Because they profit by doing so. In case you...

Zombie Foreclosures

CFPB: Zombie foreclosures hurt borrowers The Consumer Financial Protection Bureau is keeping an eye on “zombie” foreclosures, which it worries cause...

New Federal Rules on Foreclosure

New Federal Rules on Foreclosure —By Erika Eichelberger - Thanks to Mother Jones On Thursday, the Consumer Financial Protection Bureau, the federal...

Washington MERS Suits Fail

Judges Dismiss MERS Suits By Evan Nemeroff Two borrower-initiated lawsuits alleging that the Mortgage Electronic Registration Systems role in the...

Eminent Domain – Tool For Principal Reduction

There are homes by the thousand in which the home mortgage is in default and in many cases the homes are abandoned. These are homes where the...

Chapter 13 Plan Duration

No Minimum Time Length For The Ninth Circuit by Bankruptcy Law Network (BLN) Written by Michael G. Doan Thanks...

Modification on Rental

It is harder to get a mortgage modification on a rental property than it is on an owner occupied property. The rules are not as clear. You need a...

Making Home Affordable Continues

HAMP continues aiding borrowers Three firms still fall short in meeting servicing goals. Thanks to Housing Wire. Kerri Ann Panchuk December 9, 2013...

Rental Property Modification

This is a rental property modification. Ocwen was the servicer, and the investor was Washington Mutual and now Chase. The owner quit paying for 20...

$157,105 Wells Fargo Principal Reduction

JS is a hard working taxi driver. He came to us after a financial hardship, including a divorce. Ocwen is his servicer, however, the important fact...

Wells Fargo – 3 Year Modification

It is a long story, which I will tell later. For now I will just share the link with you and tell you that this modification took three years to...

Preferences

What is a Bankruptcy Preference? by KENT ANDERSON on AUGUST 16, 2010 A bankruptcy preference is a transfer made shortly before the case is filed...

Principal Reduction Modification

We just negotiated this excellent modification with Bank of America. The interest rate was reduced to 2.0%. The principal balance was reduced by...

Condemn Underwater Mortgages – Martin Andelman

Carpe Domum! The Little City that Could: Richmond, California THANKS TO MARTIN ANDELMAN Come with me to the City of Richmond in Northern...

How Long Before I Can File BK Again?

How Long Before I Can File Bankruptcy Again? There is no limit on the number of bankruptcy cases that one may file, nor on the time which must pass...

Deceptive Practices in Foreclosures

Deceptive Practices in Foreclosures Thanks to the New York Times September 13, 2013 In early 2012 when five big banks settled with state and...

Low Modification Approval Rate

This post comes from Martin Andelman. The low approval rate on modifications Martin discusses is the main reason why you should hire an attorney to...

Bankruptcy Timing

Bankruptcy Timeline Posted on August 21, 2013 by Jonathan Mitchell Thanks to Attorney Jonathan T. Mitchell. Caution: This timeline does not include...

Renters’ Rights in Foreclosure`

Renters in Foreclosure: What Are Their Rights? Federal law gives important rights to tenants whose landlords have lost their properties through...

Eminent Domain To Modify Loans

A City Invokes Seizure Laws to Save Homes Peter DaSilva for The New York Times Thanks to New York Times. Robert and Patricia Castillo paid $420,000...

Fannie and Freddie Loosen Modification Guidelines

FHFA expands suite of loan mod tools By Kerri Ann Panchuk • March 27, 2013 • 9:00am Servicers dealing with loans guaranteed or owned by Fannie...